Link Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023

Form Name : Check Aadhar Pan Card Link Status OR Link Aadhar Pan Card Online 2023

About Form : Income Tax Department has set March 31, 2023, as the last date for all citizens to link their PAN card with their Aadhaar card. The Aadhaar-PAN linking deadline now has been extended by three months from March 31 to June 30, 2023. Any person with a PAN card should immediately check their status whether their PAN card is linked to their Aadhaar card. Those who haven’t linked it till now, can link their PAN card with their Aadhaar online before 30 June 2023 or earlier from the official website @incometax.gov.in OR from the link given below.

Permanent Account Number (PAN Card)Pan Card & Aadhar Card Link 2023Check UIDAI Aadhaar Card & Pan Card Link StatusOfficial Website : https://www.incometax.gov.inWWW.THEGOVTJOBS4U.IN |

|

Important Dates

|

Fee Details

|

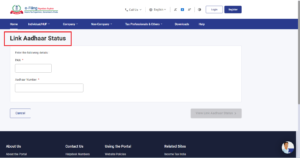

How to Check Aadhar Pan Card Link Status

|

How To Link PAN with Aadhar

|

||||||||||

Interested Persons can Link their PAN with Aadhaar from here. |

|||||||||||

Some Important Links |

|

| Link PAN with Aadhaar | Click Here |

| Check PAN Aadhaar Link Status | Click Here |

| Official Website | Income Tax Official Website |

For any Query and Feedback, Contact Us at – support@thegovtjobs4u.in |

|

FAQ – Link Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023 |

| Q. What is the official Website to Link the Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023?

Ans. The official website to check the Link Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023 is https://www.incometax.gov.in.

Q. How to check the Link Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023? Ans. To check all the information for the Link Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023, you must visit the official website at https://www.incometax.gov.in. Alternatively, you can also find the relevant information through direct links provided on this page.

Q. Which Department has released the Link Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023? Ans. The Link Pan Card with Aadhar Online or Check Aadhar Pan Card Link Status 2023 has been released by the Income Tax Department.

Q. Who needs to link Aadhaar and PAN? Ans. Section 139AA of the Income Tax Act provides that every individual who has been allotted a permanent account number (PAN) as on the 1st day of July 2017, and who is eligible to obtain an Aadhaar number, shall intimate his Aadhaar number in the prescribed form and manner. Your PAN will become inoperative if you do not link it with your Aadhaar till 30th June 2023. However, people who fall under the exempted category will not be subject to the effects of PAN becoming inoperative.

Q. For whom is Aadhaar-PAN linkage not compulsory? Ans. Aadhaar-PAN linkage requirement does not apply to any individual who is:

Note:

Q. How to link Aadhaar and PAN? Ans. Both registered and unregistered users can link their Aadhaar and PAN on the e-filling portal, even without logging in. You can use the quick link Link Aadhaar on the e-filing home page to link Aadhaar and PAN.

Q. What will happen if I don’t link my Aadhaar and PAN? Ans. Your PAN will become inoperative if you do not link it with your Aadhaar by 30 June 2023 and you shall face the following consequences as a result of your PAN becoming inoperative:

For more information, kindly refer to Circular No. 03 of 2023 dated 28th March 2023.

Q. I cannot link my Aadhaar with my PAN because there is a mismatch in my name/phone number/date of birth in my Aadhaar and PAN. What should I do? Ans. Correct your details in either the PAN or Aadhaar database such that both have matching details. In order to update your Name in PAN, please contact Protean at https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html or UTIITSL at https://www.pan.utiitsl.com/. To update your Name in Aadhaar Card, please contact UIDAI at https://ssup.uidai.gov.in/web/guest/update. You can also send a mail to the UIDAI Helpdesk via mail (authsupport@uidai.net.in) requesting specifically for data extraction for your Aadhaar Number. If the linking request still fails, you are advised to avail the option of biometric-based authentication at dedicated centers of PAN Service Providers (Protean & UTIITSL). You should carry your PAN, Aadhaar, Fee paid (of Rs.1000/) challan copy, and avail the facility after paying the requisite biometric authentication charge at the center. For details of authorized Service Providers for biometric authentication, the respective websites of Protean/UTIITSL may be visited.

Q. What should I do if my PAN becomes inoperative? Ans. These consequences of inoperative PAN shall take effect from 1st July 2023 and continue till the PAN becomes operative. A fee of one thousand rupees will continue to apply to make the PAN operative by intimating the Aadhaar number. For more information, kindly refer to Circular No. 03 of 2023 dated 28th March 2023. |

Related Posts

Instant Pan Card e-PAN Online Form

Aadhar Card Download, Book Appointment, Correction, Check Status, Order PVC Aadhar Card etc.

Pan Card Online Form, Correction, Track Status

Voter ID Online Form, Correction, Application Status