Instant Pan Card e-PAN Online Form

Form Name : Instant Pan Card e-PAN Online Form 2023

About Form : Income Tax Department, India has released the Instant Pan Card Registration 2023 notification for the Application Form of Tatkal Download Instant Print. Interested Persons can Apply Online for an Instant (e-PAN) Pan Card from the official website @incometax.gov.in OR from the link given below.

Permanent Account Number (PAN Card)Instant Pan Card (e-PAN)Official Website : https://www.incometax.gov.inWWW.THEGOVTJOBS4U.IN |

|

Important Dates

|

Fee Details

|

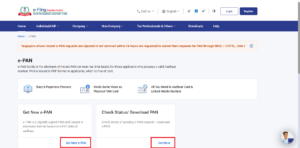

How to Apply for Instant Pan Card e-PAN Online Form

|

How To Check Instant e-PAN Status

|

||||||||||

Interested Persons can Apply Online for an Instant Pan card (e-PAN) from here. |

|||||||||||

Some Important Links |

|

| Check Status / Download E-PAN | Click Here |

| Apply Online (Instant Pan Card) | Click Here |

| Official Website | Income Tax Official Website |

For any Query and Feedback, Contact Us at – support@thegovtjobs4u.in |

|

FAQ – Instant Pan Card e-PAN Online Form |

| Q. What is the official Website for the Instant Pan Card e-PAN Online Form?

Ans. The official website to check the Instant Pan Card e-PAN Online Form is https://www.incometax.gov.in.

Q. How to check the Instant Pan Card e-PAN Online Form? Ans. To check all the information for the Instant Pan Card e-PAN Online Form, you must visit the official website at https://www.incometax.gov.in. Alternatively, you can also find the relevant information through direct links provided on this page.

Q. Which Department has released the Instant Pan Card e-PAN Online Form? Ans. The Instant Pan Card e-PAN Online Form has been released by the Income Tax Department.

Q. I have a PAN but I have lost it. Can I get a new e-PAN through Aadhaar? Ans. No. This service can only be used if you do not have a PAN, but have a valid Aadhaar and your KYC details are updated.

Q. Are there any charges/fees for e-PAN? Ans. No. It is completely free of cost.

Q. What are the pre-requisites for availing an instant e-PAN? Ans. The pre-requisite for obtaining instant e-PAN are:

Q. What documents do I require for obtaining a new e-PAN? Ans. You only require a valid Aadhaar with updated KYC details and a valid mobile number linked with your Aadhaar.

Q. Why do I need to generate an e-PAN? Ans. It is mandatory to quote your Permanent Account Number (PAN) while filing your Income Tax Return. If you have not been allotted a PAN, you can generate your e-PAN with the help of your Aadhaar and a mobile number registered with your Aadhaar. Generating e-PAN is free of cost, an online process, and does not require you to fill up any forms.

Q. The current status of my PAN allotment request status is updated as “PAN allotment request has failed”. What should I do? Ans. In case of failure of your e-PAN allotment, you may write to epan@incometax.gov.in.

Q. How will I know that my e-PAN generation request has been submitted successfully? Ans. A success message will be displayed along with an Acknowledgement ID. Please keep a note of the Acknowledgment ID for future reference. Additionally, you will receive a copy of the Acknowledgement ID on your mobile number registered with Aadhaar.

Q. I am not able to update my Date of Birth in my e-PAN. What should I do? Ans. If only year of birth is available in your Aadhaar, you will have to update the date of birth in your Aadhaar and try again.

Q. Can foreign citizens apply for PAN through e-KYC mode? Ans. No.

Q. If my Aadhaar authentication gets rejected during e-KYC, what should I do? Ans. Aadhaar authentication may get rejected due to using the wrong OTP. The problem can be resolved by entering the correct OTP. If it still gets rejected, you have to contact UIDAI.

Q. Do I need to submit a physical copy of the KYC application or proof of an Aadhaar card? Ans. No. This is an online process. No paperwork is required.

Q. Do I need to upload a scanned photo, signature, etc. for e-KYC? Ans. No.

Q. Will I get a physical PAN card? Ans. No. You will be issued an e-PAN which is a valid form of PAN.

Q. How do I get a physical PAN card? Ans. If a PAN has been allotted, you can get a printed physical PAN card by submitting a request through the links below: You can also file an offline application with Pan Service Agents for a physical PAN card.

Q. My Aadhaar is already linked to a PAN, can I apply for an instant e-PAN? Ans. If a PAN is already allotted to you that is linked to your Aadhaar, you cannot apply for an instant e-PAN. In case your Aadhaar is linked to an incorrect PAN, submit a request to the Jurisdictional Assessing Officer (JAO) for delinking Aadhaar from your PAN. After delinking, submit an instant e-PAN request. To know AO’s contact details visit: https://eportal.incometax.gov.in/iec/foservices/#/pre-login/knowYourAO

Q. I cannot apply for Instant e-PAN because my name/date of birth/gender in my Aadhaar is incorrect or my Aadhaar Number is not linked with any active mobile number. What should I do? Ans. You need to correct your details in the Aadhaar database. You can correct your Aadhaar details on: In case of Query/Assistance, please contact on toll-free number 18003001947 or 1947. To update your mobile number on Aadhaar you need to visit the nearest Aadhaar Enrolment Centre. |

Related Posts

Aadhar Card Download, Book Appointment, Correction, Check Status, Order PVC Aadhar Card etc.

Pan Card Online Form, Correction, Track Status

Voter ID Online Form, Correction, Application Status